Student Loan Debt

February 25, 2022

As students at Lakeland start looking for colleges, they’ll start looking at ways to pay for it. Most students don’t have the money out of pocket or the help of their parents, so they will start to look at student loans.

About 46 million Americans have student loan debt and the average student loan debt a person has accumulated is about $25,000 to $50,000. to pay off all this debt could take the average person 20-45 years.

Emma Fuller, a senior at Lakeland has said “I don’t know how I’ll be paying for my college yet, I’ll probably save up over the summer because my parents won’t be helping me pay for college and I don’t have any money saved up yet. I’ve been donating plasma for money to pay for my gas, so I’ll be saving up that money too but I will most likely have to take out student loans”

Students at Lakeland are struggling to find ways to pay for college. Some students have to go to extreme measures to get money because their parents won’t be helping them with college and they don’t have any money saved up. There are some ways that students can be helped.

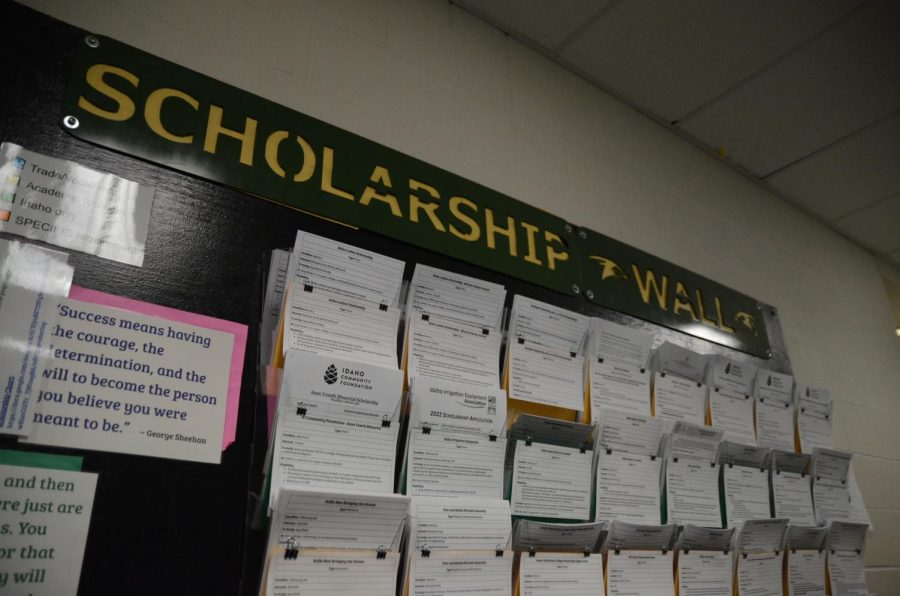

One of the best ways that you can pay for college is by applying for scholarships. About $46 million worth of scholarship money is awarded to students every year. Much of this scholarship money goes unclaimed, about 100 million dollars every year.

Although there is all of this unclaimed money, students are still struggling to find ways to pay for college. There are also some alternatives to applying for scholarships.

Carrie Paquette, Lakeland’s college advisor, has stated “Be deliberate about where you go to get your education or training and compare your options. Applying for scholarships from colleges, schools, or training programs can help offset tuition costs. Submit a Free Application for Federal Student Aid. Take some dual credit classes in high school. Earning these college credits at no cost before you go to college can help you lower the overall cost of your education¨

There are also some other options to avoid student loans, you can get on-campus jobs you can apply for to help reduce your educational costs.

When you go to college, ask about payment plan options. Rather than paying the full amount upfront each semester for your tuition, ask for a monthly payment plan that spreads your tuition out over time. This is interest-free, so it’s a much better option than most student loans.

There are many ways that you can avoid paying student loans and there are people who are at the school, like Mrs. Paquette who can help you with College Planning.