Throughout the 2024-2025 school year, the Lakeland Joint School District 272 (LJSD272) levy has been a major concern for students, staff, and community members.

Many worry about potential cuts to academic resources and opportunities, prompting several students to step up and advocate for their schools.

In May the community will be asked to consider the reduced $7.52 million levy. This levy will replace the current levy, which ends June 30, 2025.

Based on current conditions, the estimated average annual cost to the taxpayer on the proposed levy is a tax of $82.32 per $100,000 of taxable assessed value per year. The levy will be assessed for two years.

As discussions about the levy continue, several community members question how it works and where the funds will be allocated.

Where does the money go?

A supplemental levy is additional funding that school districts request from local taxpayers to cover essential costs not fully met by state funding. It is not guaranteed spending unless the levy passes.

“This means that property tax owners shoulder a tax burden to fully fund their local school district,” Suzanne Gallus, president of the Friends of Lakeland Schools PAC, said. “It also means that if we don’t like something, we can take it to the school, voice our opinion, and the schools should listen to us, because we, the tax payers, are funding the schools.

About 10-30 percent of a school’s budget comes from local property tax dollars and the rest from the state.

Idaho funds its schools based on average daily attendance (ADA), meaning schools receive money based on the number of students present each day rather than total enrollment. In the 2023-2024 school year, the district lost an estimated $2.74 million in funding ($15,917 every day) due to absences.

This means that the district loses financial support even when students are absent due to illness or other personal reasons. The levy helps bridge this funding gap.

“It is nearly impossible to rely on all students to maintain a perfect attendance record,” Lakeland junior Paige Thompson said. “Sometimes things happen that aren’t in our control, and we can’t make it to school. Unfortunately, that impacts how much funding we get from the state.”

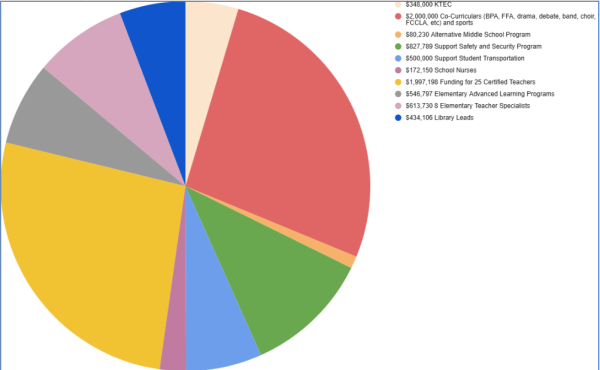

The funds are distributed into budgeted categories, including student support, safety, and extracurricular programs. They also include maintenance and staff funding.

Reduced funds from absent levy funds will affect extracurriculars, teachers, and the quality of education in LJSD272 according to school officials. Shannon LaFountaine, assistant principal at LHS, explained that they would have to cut staffing with budget cuts.

She said reduction in teaching staff would lead to larger class sizes and how larger class sizes can affect the teacher’s ability to focus on individual students and their needs; it can also create more distractions in the classroom. It would also lead to cuts in extracurricular classes such as drama, art, agriculture, and journalism. The curriculums would be reduced to only core and primary classes required for graduation.

LaFontaine also explained how the loss of sports and activities could affect the school’s culture and students’ willingness to attend school.

LHS purchases school supplies and education equipment on a rotation, but with budget cuts, they will slowly have to update fewer and fewer materials.

Fundraising not a solution

Extracurricular activities, such as sports, electives, and clubs, can be a significant part of student life at Lakeland High School, and those activities rely heavily on funding from the levy. The proposed levy allocates approximately $2 million to support these programs.

Without the levy’s support, cuts to sports programs or the implementation of pay-to-play policies would become necessary.

The athletic director at Lakeland High School, Matt Neff, explained that the budget for LHS sports and extracurricular activities funds travel, safety, coaching staff, and equipment. This funds 17 different programs at LHS, each with a varying number of coaches.

Neff explained that it is not impossible for each program to fundraise enough to cover their budgets, but it is ultimately unrealistic. The cost to cover all expenses for a student-athlete is approximately $1,800 per year, a sum many families struggle to afford, even with extensive fundraising efforts.

While participating in fundraisers can work as a team-building activity and community involvement, many Lakeland teams, clubs, and extracurricular programs already have to fundraise or spend money out-of-pocket to cover extra costs. Under a pay-to-play system, teams would spend significant time fundraising and still likely fall short of meeting the necessary financial needs.

“Do you want to spend your time developing, getting better, and being competitive, or do you want to spend your time fundraising?” Neff said.

Many have called on The Lakeland Booster Club to fill the gap.

The booster club is a non-profit organization of parent volunteers who raise money that gets granted to Lakeland. Tina Hillman, president of the Booster Club, explained that in the 2023-2024 school year, the Booster Club could give back $92,000.

So far, in the 2024-2025 school year, they have granted over $72,000.

This money is used to help support Lakeland’s programs, but could not realistically raise enough money to help with pay-to-play programs. With approximately 900 students at the estimated $1,800 pay-to-play cost mentioned by the District Office CFO, that would be more $1.6 million — 20 times what the booster club raised last year.

“The Booster Club exists to essentially fill the gaps and holes that the district cannot,” Hillman said. “When you think of what comes from the district (through levy dollars), it is only for what we need. Not what we want. So that is where the Booster Club comes in.”

Public concerns

Many community members advocate for alternate funding for public schools rather than leaning on supplemental levy funding.

“I don’t think we should have to rely on the levy,” Lakeland senior Connor Smith said. “I also don’t think we should have to rely on students showing up to school to get our funds. I think it’s a big issue in Idaho public schools, and the state needs to fund more without basing it on attendance.”

This leaves schools vulnerable, as fluctuating attendance numbers can lead to unpredictable funding, making it difficult to ensure consistent resources for students, teachers, and programs.

Several community members do not want to contribute their tax dollars to an education system of which they are uncomfortable

Community member Stephanie Gossard, who voted against the levy last time it was on the ballot, said that while she is not against education or teachers. She believes that levy funds benefit administrator salaries more than classroom instruction. She wants more accountability regarding where levy funds are allocated.

“The teachers and the students are being hurt by the higher-ups,” Gossard said.

Several other community members are worried about the district’s financial transparency. Many believe that better transparency would help ensure that the money raised through levies and taxes is being spent effectively and that there is accountability at every level.

Additionally, some community members are concerned about higher taxes. As property taxes increase, many homeowners find it increasingly difficult to afford the cost of living, especially in light of the supplemental levies necessary to maintain the quality of education.

“In my day, there were so many programs at the schools,” Gossard said. “And now most of which are gone and they were not funded by property tax levies.”

Another primary concern among residents is property taxes. Numerous letters to the editor of the Coeur d’Alene Press show that property tax increases have financially hit seniors and low-income families.

“We are being forced to sell our homes because we just can’t afford to pay the way for others,” Gossard said.

The state legislature has recently taken measures to decrease property taxes, specifically for current Idaho residents.

These efforts are part of a broader initiative to ease homeowners’ financial burdens while maintaining investments in essential public services. In 2023, Idaho allocated residents $300 million in tax relief to decrease property taxes.

“I know that my personal 272 supplemental levy tax line has decreased significantly in the past few years,” Gallus said. “Every year, we actually pay less, even though our property value has increased.”

The state also distributed $106 million to school districts across Idaho as part of Brad Little’s property tax relief plan.

“Idaho already has the third lowest property taxes in the country, and we took steps this year to lower them further,” Governor Little said in a 2023 press release. “Idaho has delivered more tax relief per capita than any other state, and we’re proud to turn money back to the hardworking people of our state while making critical investments in schools and infrastructure to keep up with growth.”

What’s next?

LJSD272 superintendent Lisa Arnold has been leading town hall meetings to discuss the district’s next steps.

A town hall meeting was held on Mar. 11, and four more are scheduled in the future to educate the community. Numerous other events to inform the community have been planned, as well. Voters are encouraged to attend these meetings and cast an educated vote.

District officials also emphasized increased financial transparency since the levy’s failure. They dedicated a portion of the website with the school’s financials, including annual independent financial audits, monthly expenditure reports, monthly districtwide financial reports, and purchasing and requests for proposals/bids.

The levy vote will take place on May 20.